Tokemetrics: Measuring the Potential Value in a Cryptocurrency

Abstract

As the cryptoverse grows, we set the lexicon of our new field. Tokenomics is the study of how a cryptocurrency is built and lends itself to understanding how a cryptocurrency is doing at the moment it is analyzed. However, business needs something that can forecast the value of a token on the market beyond the present, beyond the past and into the future. This does not have to be foolproof, but it does have to work more often or not. One of the questions that businesses present is whether a token will have a stable valuation; this is something that we can define, quantify, and turn into a usable statistic within the field. Tokemetrics is a new concept that allows the analyst to use a standard structure to build out an analytical model looking at the stability of a token over a long-term period. While the model is not designed to predict the growth or failures of a project, it can provide some comfort to businesses entering the field to look at whether the token’s value should be stable. Small analytical tools like these enable the business world to merge with the cryptocurrency world to move humanity toward a new age of access to wealth and digitization of assets.

Key Words:

Tokenomics, Cryptocurrency, Bitcoin, DeFi, Fintech, Web3, Token metrics

Introduction

Stability is one of the key elements holding back cryptocurrency advancement on a global scale. While crypto-preneurs are willing to accept 10-20% swings in valuation, traditional finance (TradFi) firms are less likely to accept that type of risk.[1] As a result, there is a gap developing between cryptocurrency investors and traditional investors - a gap that is based more on a lack of knowledge rather than a lack of options.[2] Current token metrics, such as quadratic valuation and wrought tokenomics, look at the current value and current stability of a project.[3] This is important for spot checks, but as many TradFi firms look at forecasting for investable assets, this falls short of measuring the potential value of the tokens. As such, Tokemetrics is offered as a methodology to look at the stability of a given currency.[4]

Tokemetrics is a measurement tool for the potential value of a token, relative to the current value of the token. This means that in order to have a functional Tokemetrics review, there must be a tokenomics review (such as the UN/GBA Blockchain Maturity Model [BMM]).[5] There must also be a review of the valuation, of which the quadratic approach is more recommended than a mono-variate approach.[6] These need to be established to understand the potential value of a project, as more than just a guess within the system. The Tokemetrics model offered herein is based on a cubist approach to the potential valuation of a given token.

This theoretical offering is a pilot offering. While the metrics of the system are directly related to the potential value of the token, the measurement of said variables needs to be moved from a qualitative assessment to a quantitative measurement to ensure development.[7] As such, it is better that the theoretical model be presented to the community so that thousands of minds can work on the development of the system, both independently and in concert, to ensure that the system develops in the best manner possible.

Methodology

The approach to this model is based on the hybridization of Grounded Theory, as observable data within the cryptoverse. It is our primary methodology at this point and social cubism. For Grounded Theory, the classic model proposed by Glasser and Strauss seems to be the ideal model, even forsaking more modern models such as Charmaz.[8] As for Social Cubism, the approach used by Byrne and Carter in their analysis of Ethnoterritorial Politics in Northern Ireland, though the topics are divergent, functions well to create the model.[9]

The Glasser and Straus model, in its native form, is primarily designed for the medical profession. As such, the approach to theoretical sensitivity and data collection are functional for the present task.[10] The coding process, which normally consists of Open Coding, Axial Coding, and Selective Coding, will be replaced by Recursive Frame Analysis (RFA), as developed by Chanail.[11] As this model is more modern and more suited to deal with the meta-synthesis of works in the field, its substitution is more effective. Returning to the native model, the hypothesis that there are six key areas of analysis for potential value allows us to “null hypothesis” out other factors, or in the event that a factor has a non-system or regional effect (like government interaction or adoption by institutional systems) it can be noted as a supplemental element away from the primary system.[12] The system then looks for saturation of evidence, to the point that a strong majority of new evidence is redundant. This then presents to the level where the researchers are comfortable writing this report on the findings.

The complexity of Tokemetrics dealing with potential within the cryptoverse requires the frames of the theory to be viewed through a hexi-variate lens. This fits ideally with the Byrne and Carter methodology used in the analysis of Ethnoterritorial Politics in Northern Ireland and Quebec.[13] While Byrne and Carter used: Demographics, Economics Factors, Religion, History, Political Factors, and Psychocultural Factors; this model will adjust the lens to include:

1.) Community (Demographics)

2.) Assets (Economics Factors)

3.) Governance (Political Factors)

4.) Supply/Demand Factors

5.) Use Cases/Business Use (Psychocultural Factors)

6.) History (History)

This provides a rounded approach to the model's analysis, allowing the values to be subjectively quantified.

Tokemetrics Analysis

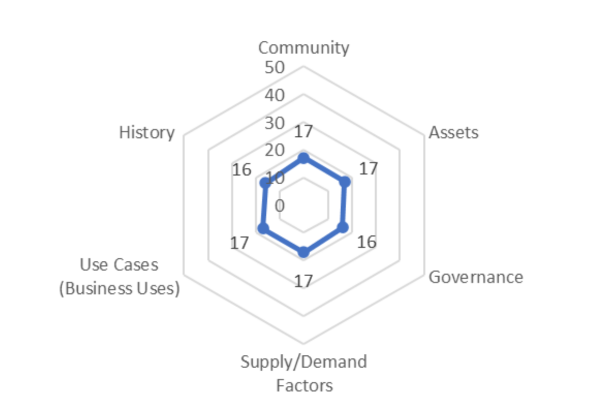

In order to present the data in a visual method, especially to allow for the analysis of the data against like systems, rather than a cube, the model is present as a radar graph, allowing the reader to see the potential stability of the token. As you can see in the above analysis, the token is balanced in its Tokemetrics system. This shows that the token has a good chance of maintaining a stable value. Conversely, in the analysis of a memecoin below, we note that the primary Tokemetric factor for the unit is community (due to the meme nature of the token. As such, we see a wild fluctuation in the relative Tokemetrics, indicating that the token’s potential is volatile.

This system does not predict the movement of the token. It simply predicts whether the token is more likely or not to be stable in value.

The Tokemetrics system not only provides insights into a token’s current state but also guides its future development. For instance, in the case of the memecoin, the system highlights the potential to enhance stability by increasing assets, use cases, or supply and demand factors. The system's adaptability, working off a base 100 system, ensures that factors such as history, community, and governance are adjusted to rectify the model. Notably, any token with values exceeding 50% is deemed overly centralized, raising concerns about its stability and control, and indicating a higher likelihood of volatility.

Data Points

Because the system works off of a six variable structure, it is important to know how the data points function and why they are important. The diversity of the cryptoverse increases the difficulty of the analysis, as different types of tokens have different models for stability- however, they all still answer to the market and quadratic valuations.

Meme Coin Tokemetrics Analysis Example

1.) Community (Demographics) -

The community of a token is made up by those who hold the token, those who use the token, those who support the token, and those who are showing interest in the token.[14] Too often, the community is limited to the Discord channel for the project - often leaving out investors, those who hold the token in a portfolio that is managed by someone else, those who discuss the token on other platforms, exchange chat communities, and those who have the token on a ‘watch list’ but are not active in the discussion of the community.[15] These divergent denizens of a cryptocurrency community all have the ability to affect the price.[16] Additionally, the media is an omnipresent member of the community, regardless of whether the media is heralding the latest success or failure of the token or remaining mute on the subject. Looking at the community involves looking at the integration, development, and communication between these factors and those who are managing the project.[17]

2.) Assets (Economics Factors) -

Cryptocurrencies are businesses, even the not-for-profit ones. This means that they have assets that need to be attached to a company or an individual.[18] This analysis can be one of the more difficult factors to look into when doing a Tokemetric analysis as many cryptocurrency companies are run by anons.[19] Legal assets are the primary category of assets that a token has at its disposal. These include the name (if copyrighted, trademarked, or "poor-man’s" copyrighted), logo (if trademarked or “poor-man’s” copyrighted), copyrighted and published white papers, any patents, intellectual property agreements, trademarks, copyrights, poor-man’s copyrights or contracts held by the company. Assets also include any physical holdings which the company may have such as land, office space, or equipment. The category of assets also includes transferable assets such as derivatives, stocks, digital assets, liquidity pools, asset pools, or any other bankable/tradable assets (CDs, Bonds, etc.).[20]

3.) Governance (Political Factors) -

A project must have a method of governance, whether it is centralized or decentralized. Governance affects the potential value because it can determine the stability of the function of the project.[21] Whether centralized or decentralized, the company should have a well-structured governance system and voting mechanism. This is, perhaps, the most subjective of the categories.[22] As the cryptoverse expands, decentralized governance mechanisms should be seen as more stable as they need a higher portion of the population to ‘vote’ to make a change in the structure. Centralized systems, however, do have more ability to adapt to changes in the environment.[23]

4.) Supply/Demand Factors -

Whether the system has a mechanism for maintaining stability within the ecosystem is of paramount importance.[24] Systems that have nothing in place have a score of 0 in this category, while systems that have a cyclic fee or burn structure can have scores as high as 20 (depending on the relative value of other elements). Traditional burns (dumb burns) have a relative score between 5-10, depending on who controls the dead wallet to which the tokens are burned.[25]

5.) Use Cases/Business Use (Psychocultural Factors) -

The more use, or utility, that a token has, the better - to a point. If the project eschews all other factors and simply has a high usage factor within a specific industry, there is still the danger of the industry having problems.[26] This can cause volatility if the Tokemetrics are too heavily vested in one segment.[27] High usage is good when the relative value is equitable with the value of the other categories.[28]

6.) History -

Short histories are dangerous and volatile histories are dangerous. Long-term, steady histories are valuable. As the industry is only 15 years, a stable history of following the roadmap the company outlined (and white paper) for two years is a stable history.[29] History, unlike the other vectors in the chart, has an optimal value between 15-20. It cannot really move beyond 25 as the field is so young.[30] Most companies that have not been hacked or had a major liquidity problem and have been in existence for over two years have a history value of 10ish. This rises to the 15-20 range if they can show that they have had a steady valuation that falls within the predicted model of the whitepaper/roadmap.

_________________________________________________________________________

As noted in the introduction, this is a pilot theoretical study. This means that these categories are suggested as the main categories for the project, but the methodologies for measuring the values should be reviewed, revised, and improved to ensure that the system grows to be a strong system. No person built the cryptoverse, nor should one control its analytical fate.

Discussion

The need for a system of Tokometrics is quite clear as businesses are looking for a way to better understand how a cryptocurrency will preform in the short and long term. To do this, there needs to be a clearly defined set of elements for which researchers can find data. Socio-Economic Cubism seems to be a functional methodology for ensuring that the Tokemetrics of the system is not limited to one lens, but spread across the spectrum of discerning factors to ensure a balanced, and more verifiable, analysis.

To this end, the community must come together to improve the data system. Statistically, the cryptoverse has the best data of any financial system on the planet. The immutable ledger ensures that all past data and present data are available for review. This means that historical analysis of a cryptocurrency is better suited to function than any other field. However, the youth of the field makes forecasting more difficult, and as such we need a strong system of Tokemetrics to ensure that the industry can fully assimilate with the TradFi system.

As a result, the discourse culminates in a pivotal question, “How can we enhance each vector?” Knowledge in a domain is a powerful tool, but when wielded without wisdom, it can lead to poor use, damage, and even the most brilliant minds appear foolish. As tokenomics evolves into a more mature field, it must strive to develop in a manner that enables seamless integration with business systems worldwide. This, in turn, can contribute to a better world where people have access to their wealth, thereby reducing the number of unbanked and underbanked individuals globally.

Sources and Annotations

[1] Staff (2024). “Statistics on How Bitcoin Moves- average rally and pullback percentages, bull/bear market durations and gains/losses.” Trade that Swing at

https://tradethatswing.com/statistics-on-how-bitcoin-moves-average-rally-and-pullback-percentages-bull-bear-market-durations-and-gains-losses/.

[2] Casey, Michael (2022). “DeFi’ and ‘TradFi’ Must Work Together.” International Monetary Fund at

https://www.imf.org/en/Publications/fandd/issues/2022/09/Point-of-View-Defi-Tradfi-must-work-together-Michael-Casey.

[3] Staff (2023). “Understanding Token-Metrics- How to Read a Crypto Token.” MIZAR at

https://mizar.com/blog/understanding-token-metrics-how-to-read-a-crypto-token.

[4] Id.

[5] Government Blockchain Association (2024). At

https://gbaglobal.org/blockchain-maturity-model/supplements/.

[6] Smithmyer, Christopher; Alli, Remi; Jadoon, Abdullah & Ashe, Ryan (2022). “Dragons of the Digital Age.” Elite Exclusivity: Detroit.

[7] Carpenter, Haley (2023). “Turn Qualitative Data into Quantitative Data & Use the Insights in Experiment Ideation.” Growth Mentor at

https://www.growthmentor.com/blog/qualitative-data-analysis-methodology/.

[8] Glaser, B., & Strauss, A. (1967). The Discovery of Grounded Theory: Strategies for Qualitative Research. Mill Valley, CA: Sociology Press. See Also Charmaz, K. (2003). Grounded theory. In J. A. Smith (Ed.), Qualitative psychology: A practical guide to research methods.

[9] Byrne, Sean & Carter, Neal (2011). “Social Cubism: Six Social Forces of Ethnoteritorial Politics in Northern Ireland and Quebec.” 22nd Annual Joint Conference of the Central States Anthropological Society and the National Association for Ethnic Studies at

https://www3.gmu.edu/programs/icar/pcs/bryce.htm?gmuw-rd=sm&gmuw-rdm=ht.

[10] Glaser & Strauss, Supra.

[11] Chenail, Ronald; Keeny, Hillary & Keeny, Bradford (1995). “Recursive Frame Analysis: A Practitioners Took for Mapping Therapeutic Conversation.” The Qualitative Report at

https://nsuworks.nova.edu/tqr/vol17/iss38/4/. The process for RFA is to break a text down into segments, then use those segments to form thematic groups (frames) which are then structured into topical groups (galleries) which can be combined in a thematic then topical pattern to make more detailed associations. This gives a strong structure to any research done through a conversational or meta-synthesis manner.

[12] Glaser & Strauss, supra.

[13] Byrne & Carter, supra.

[14] Gupta, Amit (2023). “Crypto Community Building to Ensure Project Success [2024].” SAG Ipl at

https://blog.sagipl.com/crypto-community-building/.

[15] Staff (2023). “Let’s Talk about Crytpo Community and It’s Importance.” Prestmit at

https://prestmit.com/blog/lets-talk-about-crypto-community-and-its-importance/.

[16] Id.

[17] Gupta, supra.

[18] See Smithmyer et al, supra.

[19] Smithmyer, Christopher (2023). “Digital Exchequer.” Elite Exclusivity: Detroit.

[20] See Smithmyer et al, supra.

[21] Haqshanas, Ruholamin (2023). “Why is governance important in crypto?” Techopedia at

https://www.techopedia.com/why-is-governance-important-in-crypto.

[22] Freeman Law (2024). “Decentralized Governance Mechanisms” at

https://freemanlaw.com/decentralized-governance-mechanisms/.

[23] Staff (2022). “Top 5 Blockchain Governance Models for Crypto Assets.” The Crypto Times at

https://www.cryptotimes.io/blockchain-governance-model-for-crypto-assets/.

[24] See Smithmyer et al, supra.

[25] Id.

[26] Rodrigues, Francisco (2023). “Pay and Dump? How Businesses accepting crypto payments influences adoption.” Coin Telegraph at

https://cointelegraph.com/news/businesses-accepting-crypto-payments-adoption.

[27] Staff (2024). “Cryptocurrency adoption and its Impact on Different Industries.” Fluid AI at

https://fluidai.com/blog/cryptocurrency-adoption-and-its-impact-on-different-industries.

[28] Rodrigues, supra.

[29] Pinkerton, Julie (2023). “The History of Bitcoin, the first cryptocurrency.” U.S. News and World Report at

https://money.usnews.com/investing/articles/the-history-of-bitcoin.

[30] Id.